In Clackamas County, probate laws are essential for a lawful and transparent estate settlement process. This involves meticulous asset identification and categorization, including tangible and intangible items, to ensure fair distribution according to the testator's wishes. Minimizing disputes requires clear communication, accurate documentation, and professional guidance. Proposed strategies include secure record-keeping and open communication channels between stakeholders, facilitated by local probate attorneys, to maintain transparency and adherence to legalities in estate administration.

In Clackamas County, proper estate distribution is a critical aspect of probate law, ensuring that assets are allocated fairly among beneficiaries. This comprehensive guide explores the intricate process of managing estates, from understanding local probate laws to identifying and categorizing diverse assets for equitable division. We delve into key considerations for minimizing disputes, highlighting strategies that promote transparency and strict compliance. By mastering these principles, individuals can navigate the complexities of estate administration with confidence, ensuring a smooth transition for their loved ones.

- Understanding Clackamas County Probate Laws and Their Role in Estate Distribution

- The Process of Identifying and Categorizing Assets for Equitable Division

- Key Considerations for Minimizing Disputes During Asset Distribution

- Effective Strategies for Ensuring Transparency and Compliance in Estate Administration

Understanding Clackamas County Probate Laws and Their Role in Estate Distribution

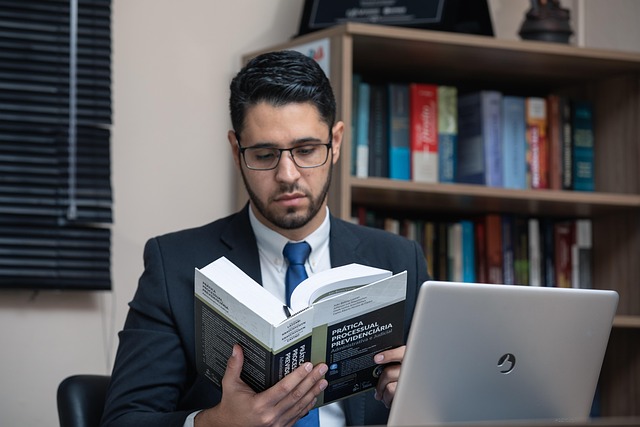

In Clackamas County, probate laws play a pivotal role in ensuring the fair and efficient distribution of estates and assets upon the death of an individual. These legal frameworks govern the process by which properties are administered, debts are settled, and beneficiaries are identified and compensated. Understanding local probate laws is essential for both executors named in a will and interested parties, as it provides clarity on timelines, requirements, and responsibilities involved in the estate settlement process.

Clackamas County probate laws establish procedures for validating wills, appointing executors, and managing the entire estate administration. They dictate how assets are valued, debts are paid, and remaining property is distributed according to the instructions outlined in the will or, if none exists, as per state default rules. Knowledge of these laws empowers individuals to plan their estates effectively, ensuring their wishes are respected while also protecting the rights of beneficiaries.

The Process of Identifying and Categorizing Assets for Equitable Division

In the context of estate distribution, especially in Clackamas County probate matters, the first step is to identify and categorize all assets. This involves a thorough review of financial records, property deeds, and other legal documents to ensure nothing is overlooked. Every asset, whether tangible or intangible, must be accounted for, including real estate, investments, bank accounts, jewelry, vehicles, and even digital assets like cryptocurrency.

Once identified, these assets are categorized based on their type, value, and legal classification. This process ensures that distribution is fair and equitable according to the wishes of the deceased, as expressed in their will or trust documents. In Clackamas County probate court, this meticulous categorization plays a crucial role in administering the estate in a manner that respects the rights and interests of all involved parties.

Key Considerations for Minimizing Disputes During Asset Distribution

When it comes to estate and asset distribution in Clackamas County probate, minimizing disputes is paramount for families. Key considerations include clear communication among all parties involved, ensuring all legal documents are accurately completed and executed, and establishing a transparent process for handling and dividing assets. Open discussions about wishes and expectations can prevent misunderstandings later on.

Additionally, seeking professional guidance from experienced attorneys or financial advisors is invaluable. They can help navigate the complexities of probate laws in Clackamas County, ensuring that distributions comply with legal requirements. Timely and organized actions, from creating a will to implementing trust funds, can also reduce the risk of disputes arising from confusion or delays.

Effective Strategies for Ensuring Transparency and Compliance in Estate Administration

To ensure transparency and compliance in estate administration, particularly within the context of Clackamas County probate, several effective strategies can be implemented. Firstly, meticulous record-keeping is paramount. Every transaction, document, and communication related to the estate should be meticulously documented and stored securely. This includes financial records, property deeds, and all correspondence between executors, beneficiaries, and relevant legal entities. Such comprehensive record-keeping facilitates accountability and provides an auditable trail, ensuring that all actions are above board.

Additionally, regular communication channels should be established and maintained among all stakeholders involved in the probate process. Beneficiaries and their representatives should receive clear updates on the estate’s progress, including any significant developments, decisions made, and their rights and responsibilities. Open dialogue helps to build trust and allows for the early resolution of any concerns or discrepancies, thereby streamlining the entire distribution process. In Clackamas County, local probate attorneys can guide executors through these practices, ensuring compliance with all legal requirements and best practices in estate administration.